Four components of the new business model

To navigate these steps, it’s important to have a clear understanding of your organization’s goals and requirements. Optum Tax Solutions can help you take the next steps.

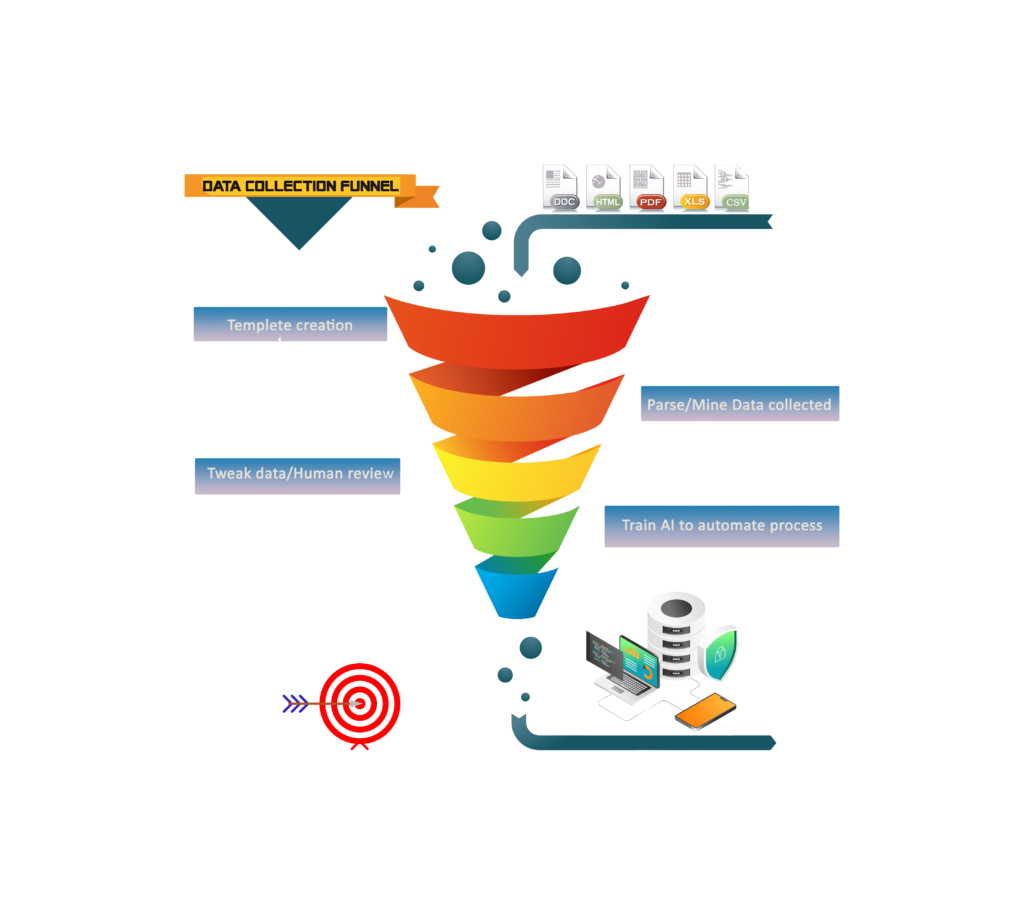

Data collection, interpretation and migration

The importance of data cannot be overstated in today’s business landscape. Organizations that effectively utilize and leverage data have a strategic advantage over their competitors. Data and analytics efforts are most often applied to customer-facing activities, leading to improved efficiencies and competitive advantages for 70% of organizations.

One of the barriers to improving data processes is the cost of software. Many organizations resort to patchwork fixes and stopgap data pipelines, leading to inefficiencies and unreliable data processing. This approach is not sustainable, especially with increasing data governance regulations and compliance requirements.

By incorporating AI into data management processes, organizations can unlock the full potential of their customer data more efficiently, improve data quality, and enhance decision-making capabilities.

Email marketing, Website Ranking

AI can greatly enhance the personalization of email marketing campaigns. Here are a few ways AI can be utilized:

Customer Behavior Analysis: AI can help determine the most relevant content to deliver to individual customers.

Optimal Send Times: AI can analyze data on customer behavior and identify the most optimal times to send emails to different segments of your customer base.

Dynamic Content: Through the utilization of AI, you can personalize product recommendations in real-time based on the customer’s recent browsing or purchase history.

By harnessing the power of AI, organizations can deliver highly personalized and relevant email marketing campaigns that result in better customer engagement, improved conversion rates, and ultimately, increased ROI.

Keeping it all secure

The decision to use a public cloud or a private cloud depends on various factors such as security requirements, cost considerations, and specific business needs. Here are some key points to consider when deciding between the two:

- Security, Cost, Control and Flexibility and Scalability

In summary, there is no one-size-fits-all answer to the question of whether to use a public cloud or a private cloud. It depends on factors such as security requirements, cost considerations, control needs, and scalability requirements. Many organizations adopt a hybrid cloud approach to balance the benefits of both public and private clouds to meet their specific needs.

Helping in this new frontier

Define your objectives, Assess your current state, Develop a plan, Implement tools and techniques to collect relevant and high-quality data, AI implementation and Website refresh or build-out.

Optum Tax Solutions can help you navigate and implement a solution that meets your current needs and will offer the growth you need to effectively blend the human component into the process, reducing repetitive work, to focus on results.

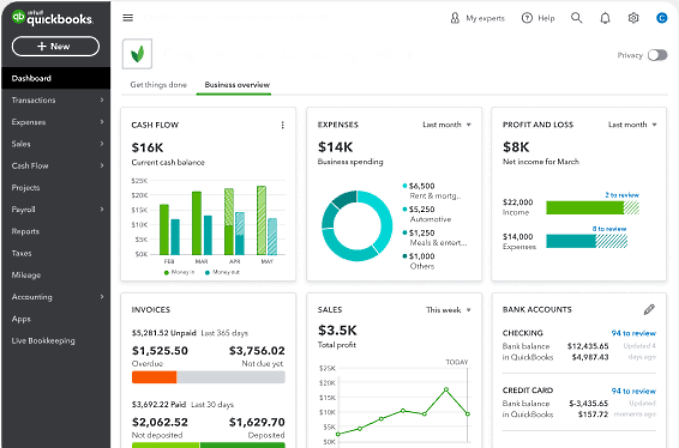

Quickbase

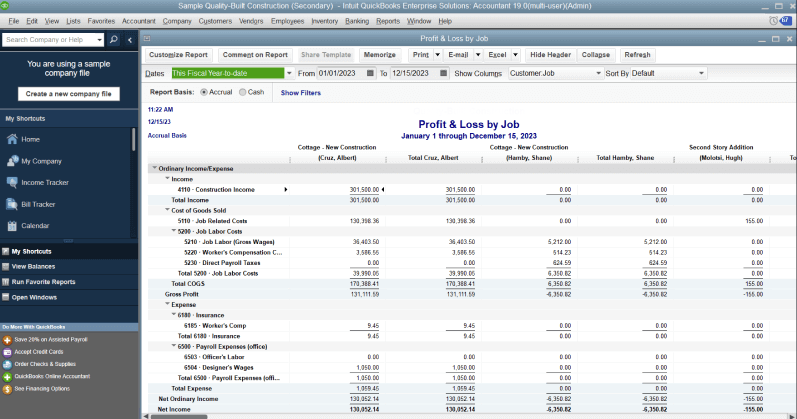

QuickBooks Accounting Services;Online or Desktop

Optum Tax Solutions LLC can assist your business with the tedious day-to-day bookkeeping. Let us provide the level of service you need to focus on business growth. Our Services include; Financial Statements, Bank and Credit Card Reconciliations, Accounts Payable, Accounts Receivable, Billing, Deposits, Payroll, and more.

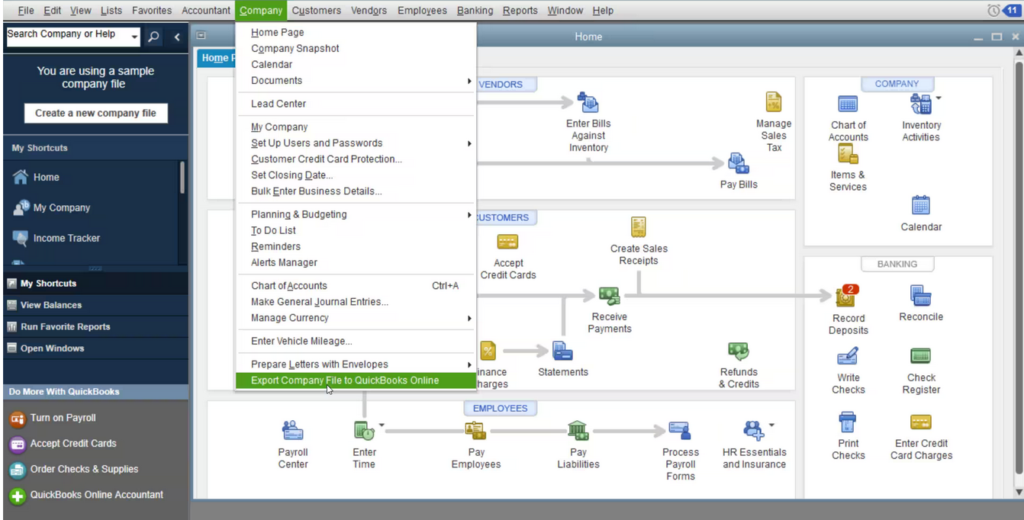

Optum Tax Solutions can assist with start-ups, cleanup, catch-up and/or ongoing maintenance, as well as training new staff or filling in for a staff member on leave. We work with QuickBooks Enterprise Pro and QuickBooks Online. If you are looking to migrate your data to QuickBooks, we can assist in porting

data from your existing platform.

Optum Tax Solutions provides comprehensive bookkeeping services that your businesses can contract with to maintain your books, properly categorize expenses and perform reporting. Our Staff will work with you team virtually and can provide monthly or as needed Zoom meeting sessions. There is a cleanup fee

to get started and get your books in order, and then pricing drops to a set monthly fee based on the sales volume of your company.

QuickBooks Accounting Services with Optum Tax Solutions offers cost effective way to get the bookkeeping that will make tax time easier and help keep you from audit issues.

Let Optum Tax Solutions LLC start helping you grow your business and create a better financial picture by utilizing QuickBooks Accounting Services. A bookkeeping specialist can gather pertinent information of the specific expectations and discuss pricing and start up fees. Clients that choose to use our booking services will receive a discount on tax preparation.